Fundraising Ideas for Your Church You can use the following 9 strategies to raise funds for your church and keep it vibrant and enjoyable! 1. Baby Sitting Even parents deserve […]

Read More

What Are Good Church Fundraising Ideas According to Experts? Follow These 5 Ideas

Fundraising Ideas for Your Church You can use the following strategies to raise funds for your church and keep it vibrant and enjoyable! 1. Funky Hat Day Allow your congregation […]

Read More

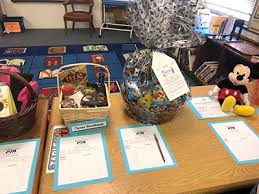

10 Awesome Auction Fundraiser Ideas for Your Next Fundraiser

Auctions are a fantastic way to raise funds for your cause while engaging your community and donors in a fun and exciting event. Whether you’re planning a charity auction for […]

Read More

5 Must-Know Tips for Silent Auction Items

Silent Auction Item Ideas So, what should be up for bid at a silent auction? Silent auctions hold many opportunities to gain long-term supporters, and it is your job to […]

Read More

Take Advantage Of Best Auction Items 2024 – Read These 7 Tips

As the year unfolds, the world of auctions continues to dazzle enthusiasts with an eclectic array of items that embody exclusivity, elegance, and innovation. From rare collectibles to cutting-edge technology, […]

Read More

The History of Silent Auction Items that Sell Well

Nonprofits have huge expenses, and fundraising is necessary to make a change for your cause. There are salaries, operating costs, and projects that need to be paid for, and raising […]

Read More

Knowing These 10 Secrets Will Make Your Elk Hunt Guide Look Amazing

Elk hunting isn’t merely a sport; it’s a deeply rooted tradition that connects hunters to the wilderness in a profound way. Pursuing these majestic creatures requires skill, patience, and […]

Read More

5 Reasons the Amish Were Right About Universal Studios Donation Requests

Universal Studios, the iconic entertainment destination synonymous with cinematic wonder and thrilling experiences, often finds itself at the forefront of philanthropic endeavors. Through its Universal Studios Donation Request program, the […]

Read More

Tips for Making an Elite Island Resorts Donation Request

In a world where corporate responsibility is becoming increasingly important, elite island resorts are stepping up to the plate, not just as providers of luxurious getaways, but as contributors to […]

Read More

How to Receive Donations from Companies That Give Donations to Individual? Tips

A well-known fact about Americans is that they are givers. This is particularly true regarding giving to nonprofits, charitable organizations, and worthy causes. Companies are willing to donate to fundraisers through […]

Read More